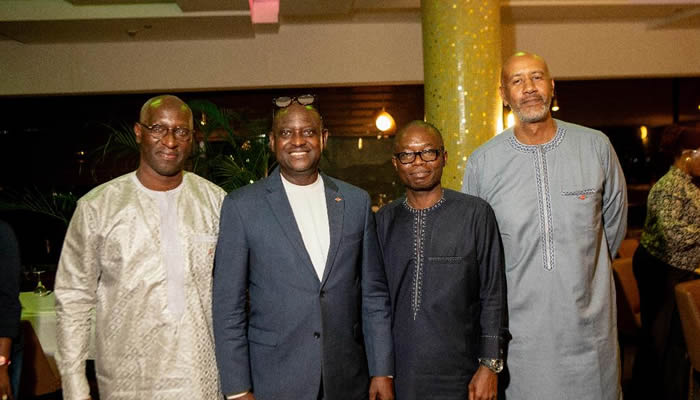

From Left: Chairman of the Executive Committee, SUNU Group, Mohamed-Lamine Bah; Managing Director/CEO, SUNU Assurances Nigeria Plc, Samuel Ogbodu; General Manager, Risk Management & Financial Control, Elie Ogounigni; and Deputy Chief Executive Officer, Karim-Franck Dione during the Business Dinner Meeting for insurance brokers in honour of SUNU Group executives who visited the country from Senegal. | Credit: SUNU Assurances Nigeria Plc

The SUNU Group, the parent company of SUNU Assurances Nigeria Plc, has reaffirmed its long-term commitment to Nigeria’s insurance sector, pledging to meet any recapitalization thresholds stipulated by regulatory authorities once the Nigerian Insurance Industry Reform Bill is signed into law.

This assurance was given by Karim-Franck Dione, Deputy CEO of SUNU Group, during a recent business dinner in Lagos held in honour of visiting executives from the group and attended by key insurance brokers and stakeholders.

The reform bill, currently awaiting presidential assent, proposes a significant increase in minimum capital requirements across the insurance industry. Life insurers would be required to raise their capital from N2 billion to N10 billion, non-life insurers from N3 billion to N15 billion, while reinsurers would see a hike from N10 billion to N35 billion. In addition to financial reforms, the bill also aims to strengthen consumer protection and enhance regulatory oversight.

“We believe in Nigeria, and we are here to stay,” said Dione. “SUNU is a financially strong group. Whatever the level of recapitalization required, we will meet it. This is a firm commitment from our major shareholders, made in the presence of the Board and our entire management team.”

While acknowledging the challenges of doing business in Nigeria, Dione emphasized the country’s unmatched potential as an economic powerhouse in Africa.

“Doing business here is not easy, but Nigeria makes sense. It’s the largest market in sub-Saharan Africa after South Africa, and its people are competent and resourceful. For any African investor, Nigeria is the place to be,” he noted. “With the right people and strategic intelligence, progress is inevitable despite daily challenges.”

Dione cited poor power supply, inadequate infrastructure, and regulatory complexity as some of the hurdles foreign investors face. However, he praised Nigeria’s dynamic insurance landscape, where over 56 companies compete for market share — a level of competition he described as “even more than France.”

“The regulation is strict, the competition is intense, but that’s the strength of the market,” he said.

On improving insurance penetration, Dione stressed the need for enforcement of compulsory insurance laws and the expansion of product offerings.

“Every building should be insured against fire. Public structures must be covered. Enforcement is critical. Without it, the industry will rely solely on the goodwill of informed citizens.”

Also speaking at the event, Mr. Samuel Ogbodu, Managing Director/CEO of SUNU Assurances Nigeria Plc, highlighted lack of awareness as a key barrier to insurance uptake.

“Awareness is the main issue. Many Nigerians don’t understand the benefits of insurance. That’s why SUNU is focused on education and engagement,” Ogbodu said. “We want the public to know that if you are involved in a motor accident or suffer a health-related issue under your policy, we will pay your claim.”

He emphasized that SUNU has built a strong reputation for prompt claims settlement — a core part of its brand promise.

“The SUNU philosophy is clear: if a customer has paid their premium and the claim is genuine, it must be settled without delay. We don’t want policyholders to suffer.”

Ogbodu also commended insurance brokers for their continued trust in the company and expressed the firm’s willingness to deepen collaborations for better service delivery across Nigeria.

“We appreciate the brokers who have found us worthy partners. We are committed to doing more and ensuring Nigerians receive the best in insurance coverage.”

SUNU Group’s reaffirmed commitment comes at a time when regulatory reform, digital adoption, and consumer education are viewed as essential levers to unlock the full potential of Nigeria’s insurance industry.