In the bustling Ile-Epo market, where traders juggle sales, rising costs, and the ever-present risk of financial shocks, ASHA Microfinance Bank is introducing a new safety net. The bank, a Nigerian subsidiary of ASA International Group, has rolled out its Lifecare Scheme, an insurance-backed initiative designed to protect small business owners and low-income families from unexpected losses.

The scheme, launched in partnership with Turaco, Africa’s leading microinsurance technology provider, and Leadway Insurance, embeds credit life insurance into ASHA’s loans. For a premium starting at ₦280 monthly, traders gain access to coverage worth up to ₦1 million, shielding them against medical emergencies, the loss of a breadwinner, or business disruptions such as fire or theft.

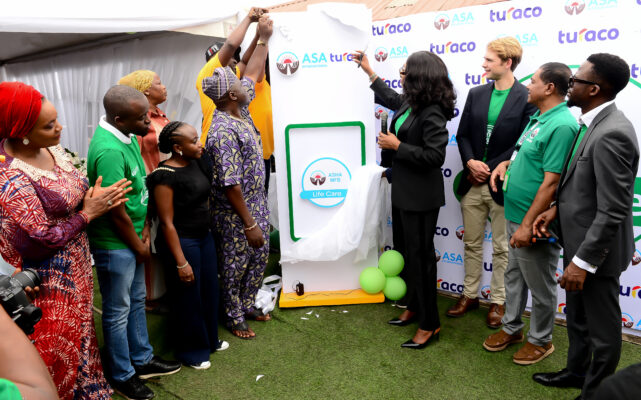

A Community-Centered Launch

The unveiling doubled as a community health and sanitation drive at the Bola Ahmed Tinubu Ultra-Modern Market, Ile-Epo. Traders, community leaders, and ASHA officials swept through the market together, symbolizing what the bank described as its “collective responsibility” approach.

For Agboola Shalewa, a trader who has banked with ASHA for 15 years, the scheme is more than an add-on. “I and other market women have accessed loans of up to five million naira with repayment terms that allow us to sleep at night. Now, with insurance attached, we no longer fear that sickness or sudden losses will throw our families into debt,” she said.

Bridging an Insurance Gap

Nigeria’s insurance penetration rate remains under three percent, one of the lowest in Africa. ASHA’s Managing Director and CEO, Funmilola Paseda Oladoyinbo, said the Lifecare Scheme is part of a broader push to close that gap.

“We don’t plan for sickness, death, or losses, but these realities disrupt families every day. This product helps our clients protect themselves and their children while building financial resilience,” she said, adding that the bank hopes to onboard 500,000 clients for the product within months through grassroots sensitization programs.

The coverage extends beyond borrowers. Customers can add children to the policy, gaining hospitalization benefits of up to 15 days annually. Claims are processed digitally, with Turaco enabling customers to file requests via WhatsApp and receive payouts within 12 hours.

Industry Impact

ASHA currently serves around 170,000 clients across 270 locations, with women making up the majority. By embedding microinsurance in loan products, the bank expects to boost both customer loyalty and long-term financial stability.

According to Andrew Amedu, ASHA’s Executive Director of Operations, the scheme is deliberately positioned as more than credit protection. “This is about building resilience. Credit life provides not only repayment support but also cover for hospital stays and business asset losses. It’s comprehensive protection designed for the realities of our customers,” he said.

Turaco’s Director of Business Development, Cedrick Todwell, framed the product as a turning point for inclusion: “This partnership shows how financial products can be designed around the real needs of Nigerian entrepreneurs. With ASHA’s grassroots reach, more than 150,000 borrowers now have access to automatic insurance coverage.”

Looking Ahead

The Lifecare Scheme highlights a growing trend in Nigeria’s financial services sector: embedding insurance in everyday products to reach underserved markets. For women traders like Shalewa, it offers not just protection but peace of mind.

“We no longer just borrow; we are learning how to protect what we have,” she said.