Consolidated Hallmark Holdings Plc has taken a major step toward becoming a one-stop financial services hub with the launch of CHI Life Assurance Limited, its new life insurance subsidiary. The company secured an operational licence from the National Insurance Commission (NAICOM) on March 10, 2025.

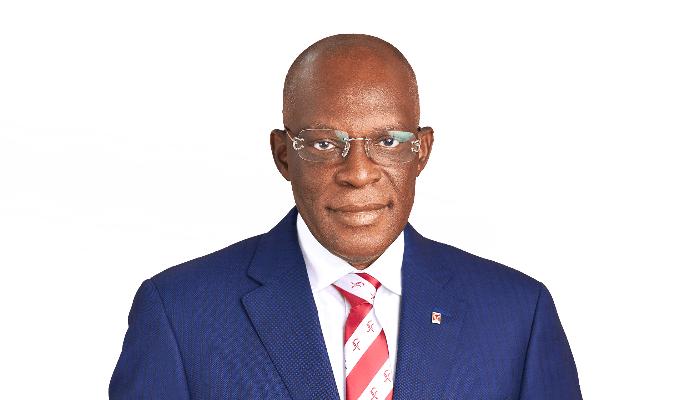

Group CEO and Chairman of CHI Life, Eddie Efekoha, said the milestone fulfils a long-standing ambition of the group. Until now, its insurance offerings were limited to microinsurance, which capped coverage at ₦2 million per individual. The new licence removes that restriction and allows CHI Life to play in the mainstream life assurance market.

“We aspired to become a one-stop shop for insurance and other financial services, and with this licence we are very close to achieving that dream,” Efekoha said, adding that a formal launch will take place in the coming weeks.

Growth Potential in Life Assurance

Nigeria’s life insurance segment remains underdeveloped. Of the ₦1.56 trillion in industry premiums generated in 2024, only ₦470 billion came from life policies, compared with ₦1.1 trillion from non-life. Efekoha believes this gap presents an opportunity.

“Beyond death benefits, life assurance builds savings for individuals while creating long-term funds for investment,” he said. “With the backing of our group’s reputation and technology investments, CHI Life is positioned to grow value for stakeholders.”

CHI Life plans to introduce innovative, investment-linked products targeted at professionals, families, and entrepreneurs, while also expanding financial literacy and improving distribution channels through digital platforms.

Capital Strength and Regulation

Efekoha also addressed the recently enacted Nigeria Insurance Industry Reform Act (NIIRA) 2025, which raised the minimum capital requirement for life insurers from ₦2 billion to ₦10 billion. He noted that CHI Life had proactively set aside ₦8 billion at inception and is backed by the group’s shareholders’ funds of over ₦34 billion.

“We are well positioned to meet the new requirements and will consider acquisitions of smaller players as part of our growth strategy,” he said.

Economic Outlook

On the broader economy, Efekoha described 2025 as relatively stable compared to previous years, citing a steadier naira in the ₦1,500–₦1,600/$ range and moderating inflation. He said the improved predictability is helping businesses plan more effectively, which bodes well for long-term industries like insurance.

“Even in challenging times, life assurance remains relevant,” he said. “It provides protection, builds generational wealth, and creates a disciplined pathway for savings. These are values Nigerians are increasingly embracing.”

With CHI Life now added to its portfolio—which already includes general insurance, microinsurance, health management, and finance—the Consolidated Hallmark Group says it is closer than ever to its ambition of becoming a fully integrated financial services provider.