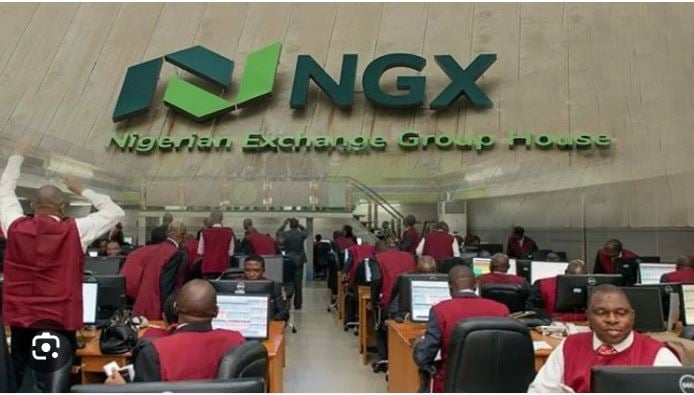

The Nigerian stock market closed last week on a strong note, advancing 4.5 per cent as renewed buy interest in industrial goods and oil and gas stocks lifted investor sentiment. The rally has pushed the All-Share Index (ASI) to a year-to-date gain of 51.2 per cent, underscoring sustained confidence in the equities market.

With the third-quarter earnings season underway, analysts expect trading activity to intensify as listed firms begin to publish results and declare dividends.

“Investor sentiment will be largely influenced by 9M:2025 earnings releases and dividend declarations, which should bolster buying interest from dividend-seeking investors,” analysts at Meristem Securities said in a market note ahead of the week.

They added that the latest inflation data — which showed a drop in headline inflation to 18.02% year-on-year in September from 20.12% in August — could encourage expectations of further interest rate cuts, thereby improving the appeal of equities.

In its weekly review, Premium Times identified a set of five stocks with strong fundamentals that investors may consider watching closely this week. (This list is not a buy, sell, or hold recommendation; investors are advised to consult their financial advisers before making decisions.)

United Bank for Africa (UBA)

UBA tops this week’s watchlist, trading below its estimated intrinsic value. The lender’s net profit ratio (NPR) stands at 22.3 per cent, while its price-to-earnings (P/E) ratio is 2x, indicating potential undervaluation. The bank’s relative strength index (RSI) sits at 27, suggesting room for upside momentum.

NEM Insurance

NEM Insurance remains a strong contender, also trading below intrinsic value. The insurer’s NPR is 25.9 per cent, with a P/E ratio of 4.1x and an RSI of 54.9, reflecting steady market strength.

Northern Nigerian Flour Mills (NNFM)

NNFM earns its place on the list for its resilient fundamentals. The firm’s NPR is 4.3 per cent, P/E ratio 9.9x, and RSI 96.8, showing strong price momentum and positive investor sentiment.

AIICO Insurance

AIICO Insurance is included for its stable performance. It has a 6.3 per cent net profit ratio, a 10x P/E ratio, and an RSI of 42.8, indicating balanced trading activity.

Mutual Benefits Assurance

Mutual Benefits rounds out the list with solid fundamentals and a growing investor base. The underwriter posts a 13.1 per cent NPR, 4.3x P/E ratio, and 29.6 RSI, suggesting potential value for medium-term investors.

As the earnings season unfolds, analysts expect volatility to increase as investors rebalance portfolios in response to corporate results and macroeconomic signals.