Dangote Refinery set for NGX debut

One of the most anticipated developments is the proposed listing of the Dangote Refinery, Africa’s largest petroleum refining facility, valued at about $20 billion.

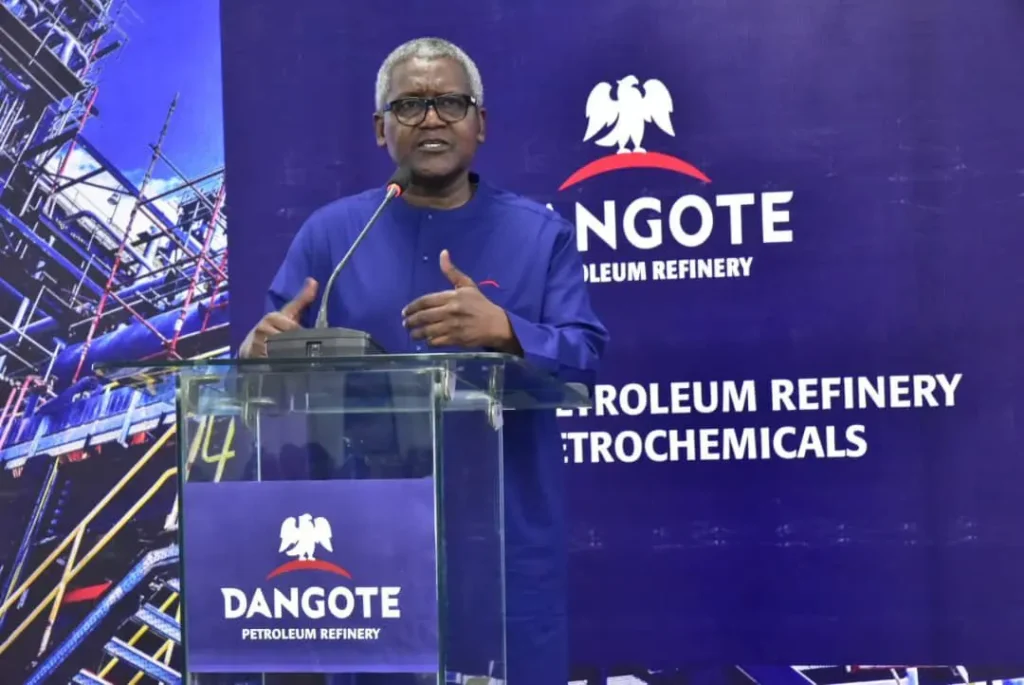

On December 12, 2025, President of Dangote Industries Limited, Aliko Dangote, announced plans to list a 10 per cent stake in the refinery on the NGX in 2026. He also revealed that discussions were ongoing with market regulators to allow dividend payments in US dollars, a move aimed at protecting investors against currency volatility.

“You buy in naira, but you get dividends in dollars,” Dangote said while unveiling the company’s Vision 2030 strategic roadmap in Lagos.

He added that the group was working closely with the NGX and the Securities and Exchange Commission (SEC) to finalise the structure of the proposed initial public offering (IPO), noting that regulatory approvals would be required from the Ministry of Finance.

Market analysts believe the listing could deepen market liquidity, boost investor confidence, and significantly expand the NGX’s market capitalisation.

Banking sector recapitalisation enters final stretch

The banking sector recapitalisation exercise, announced by the Central Bank of Nigeria (CBN) in March 2024, is another major development expected to influence economic activity in 2026.

Under the new framework, commercial banks with international licences are required to maintain a minimum capital of ₦500 billion, national banks ₦200 billion, and regional banks ₦50 billion. For non-interest banks, the thresholds are ₦20 billion for national licences and ₦10 billion for regional licences.

The 24-month compliance window ends on March 31, 2026, prompting banks to accelerate capital-raising efforts. As of early January, about 20 banks had reportedly met the new requirements.

Tier-one lenders with international presence—including Access Bank, Zenith Bank, GTBank, United Bank for Africa (UBA), First Bank, and Fidelity Bank—have surpassed the ₦500 billion threshold, securing the revalidation of their international licences.

Among national banks, FCMB, Wema Bank, Standard Chartered, and Citibank have met the ₦200 billion requirement. Other lenders that have cleared their capital thresholds include Stanbic IBTC, Sterling Bank, Providus Bank, Globus Bank, and Premium Trust Bank, as well as merchant banks such as FSDH, Greenwich, Nova, and Rand Merchant Bank.

Mergers, acquisitions reshape banking landscape

The recapitalisation drive has also triggered a wave of mergers, acquisitions, and strategic licence downgrades.

Unity Bank and Providus Bank are reportedly in advanced merger talks that could result in a new top-10 lender by asset size. Titan Trust Bank has completed the integration of Union Bank, significantly strengthening its market position.

Some banks have opted for strategic downgrades rather than expansion. Nova Bank, for instance, transitioned to a regional banking licence with a ₦50 billion capital base.

Non-interest banks have also shown resilience, with Jaiz Bank, Taj Bank, and Lotus Bank meeting the ₦20 billion capital requirement for national licences. CBN Governor Olayemi Cardoso recently said the recapitalisation process remains firmly on track.

Insurance recapitalisation gathers momentum

The insurance sector is also undergoing a major capital overhaul, with a recapitalisation deadline set for July 2026 under the Nigeria Insurance Industry Reform Act (NIIRA) 2025.

With about seven months to the deadline, insurers have begun raising capital to meet the revised minimum requirements. Recently, LASACO Assurance Plc secured shareholder approval to increase its share capital from ₦11.08 billion to ₦36.08 billion through a mix of rights issues and private placements.

The move is aimed at exceeding the ₦25 billion minimum capital requirement for composite insurers and strengthening underwriting capacity in a more competitive market.

Other insurers—including SUNU Assurances, Sovereign Trust Insurance, Linkage Assurance, Guinea Insurance, Veritas Kapital Insurance, and International Energy Insurance—have announced plans to raise a combined ₦70 billion, subject to shareholder approval.

Industry data show that several insurers already exceed regulatory thresholds. AIICO Insurance leads composite insurers with a capital buffer of ₦40.77 billion, followed by Cornerstone Insurance with ₦36.65 billion. In the general insurance segment, NEM Insurance tops the list with a surplus of ₦51.83 billion above the ₦15 billion requirement.

Tax reforms take effect

Another major shift in 2026 will be the full implementation of Nigeria’s newly enacted tax laws. President Bola Tinubu signed four landmark tax reform bills into law in June, marking what officials describe as the most significant overhaul of the tax system in decades.

The laws—the Nigeria Tax Act, Nigeria Tax Administration Act, Nigeria Revenue Service (Establishment) Act, and Joint Revenue Board (Establishment) Act—will operate under a unified authority, the Nigeria Revenue Service, and are scheduled to take effect from January 1, 2026.

Although the reforms initially faced resistance from lawmakers and key stakeholders, analysts say their implementation could reshape business operations across sectors, including manufacturing, oil and gas, trade, and investment.

Budget discipline under scrutiny

Budget implementation will also be in focus. Nigeria has faced criticism for operating multiple budgets simultaneously, a practice analysts say weakens fiscal discipline.

In 2024, the country operated three budgets concurrently—the inherited ₦21.8 trillion 2023 budget, a ₦2.17 trillion supplementary budget, and the ₦28.7 trillion 2024 appropriation. The trend persisted in 2025, with the capital component of the 2024 budget extended twice, ultimately running through December 2025.

President Tinubu has pledged to end the practice, announcing that Nigeria will return to a single-budget cycle by March 31, 2026.

Outlook

With a refinery listing of global significance, sweeping financial sector recapitalisation, far-reaching tax reforms, and tighter fiscal management, 2026 is shaping up as a critical year for Nigeria’s economy—one that could redefine investor confidence and long-term growth prospects ahead of the next general elections.