Linkage Assurance Plc has introduced a new mobile application designed to improve customer experience and expand digital access to insurance services across Nigeria. The app—now available on both iOS and Android—marks a significant step in the company’s efforts to simplify insurance processes and enhance service delivery.

The Linkage Assurance App provides users with a fast, secure, and convenient platform to purchase, verify, and manage motor insurance policies. Customers can obtain authentic motor insurance certificates, renew policies, and access instant support directly from their smartphones.

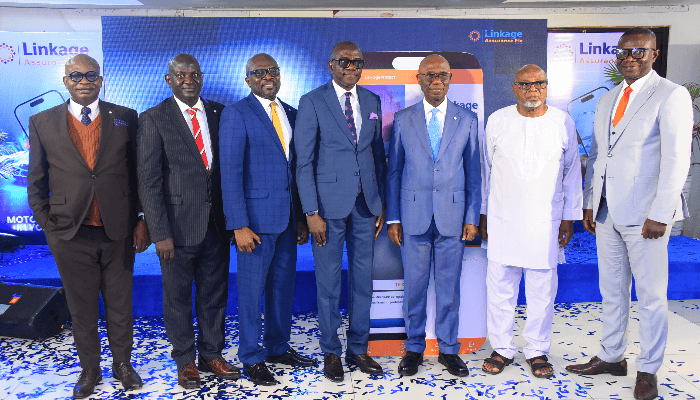

Speaking at the launch event in Lagos, the managing director/CEO of Linkage Assurance Plc, Daniel Braie, described the initiative as a major milestone in the company’s digital transformation agenda.

“Our goal is to make insurance simple, transparent, and accessible to everyone. The Linkage Assurance App demonstrates our commitment to customer-centric innovation and our vision of deepening insurance penetration through technology,” he said.

Key features of the app include secure payment options, a real-time policy management dashboard, and round-the-clock customer support—all designed to ensure a smooth and reliable digital experience. While the current version focuses primarily on motor insurance, the company revealed that additional product categories, including general, retail, and corporate insurance offerings, will be integrated in upcoming updates.

Industry analysts note that the launch underscores the growing role of digital innovation in Nigeria’s insurance sector, as consumers increasingly demand speed, convenience, and mobile accessibility in financial services.

Linkage Assurance believes the app will not only enhance convenience for existing customers but also attract new users—particularly tech-savvy young Nigerians seeking mobile-first financial solutions.

As one of the country’s leading insurers, Linkage Assurance Plc offers a broad range of products across motor, fire, marine, engineering, agriculture, general business, and oil & gas segments. The company remains committed to service excellence, digital advancement, and long-term value creation. It currently holds a Financial Strength Rating of B+ (Good) and a Long-Term Issuer Credit Rating from global rating agency AM Best.