The Federal Government has charged insurance directors to lead with transparency, innovation, and accountability as the country pushes forward with sweeping reforms to strengthen its financial sector.

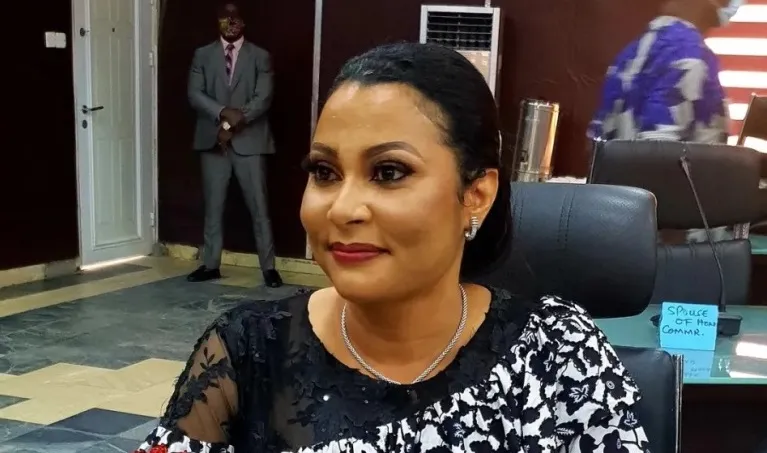

Minister of State for Finance, Dr. Doris Uzoka-Anite, described the insurance industry as “the silent engine of a resilient economy” during her address at the 2025 Insurance Directors’ Conference held Wednesday in Lagos.

Speaking on the theme “Navigating the New Insurance Landscape: Strategies for NIIRA 2025 Compliance and Growth,” Uzoka-Anite said the sector’s transformation is central to the success of the Nigeria Insurance Industry Reform Agenda (NIIRA 2025) — the government’s flagship plan to reposition insurance as a key driver of national growth.

“Insurance cushions enterprise shocks, sustains families during crises, protects national assets, and boosts investor confidence,” the minister said. “Through NIIRA 2025, we are laying the foundation for a 21st-century insurance sector — transparent, digital, and globally competitive.”

Uzoka-Anite urged boards and directors to take ownership of the reform process by embedding good governance and digital innovation at the heart of their institutions.

“This is not the time for complacency,” she warned. “Directors are custodians of governance and strategy. Your decisions determine the credibility and sustainability of the sector.”

She noted that the Tinubu administration envisions an insurance industry that significantly boosts GDP, channels long-term capital into infrastructure, and extends financial protection to underserved Nigerians in both urban and rural communities.

The minister also highlighted the close coordination between the Ministry of Finance and the National Insurance Commission (NAICOM) on policy alignment — including strengthening solvency frameworks, advancing InsurTech development, and deepening collaboration among financial regulators.

“The future of insurance lies in inclusion,” she added. “When insurance becomes accessible to farmers, artisans, transport workers, and small businesses, it will truly become a social and economic equaliser.”

In his remarks, NAICOM Commissioner and Chief Executive, Olusegun Omosehin, described NIIRA 2025 as a turning point for the industry — designed to modernise regulation, rebuild public trust, and recapitalise insurers for global competitiveness.

Omosehin revealed that NAICOM had completed its review of recapitalisation plans submitted by insurance companies following the September 30, 2025 deadline. The next phase, he said, will focus on implementation.

“We will begin official communication with each company on the outcome of our review and provide guidance to ensure a smooth process,” he said. “Good governance is not merely a regulatory expectation — it is a moral duty.”

Both Uzoka-Anite and Omosehin reaffirmed that the insurance sector remains pivotal to President Bola Tinubu’s goal of building a $1 trillion economy by 2030, positioning insurance as both a financial shock absorber and a powerful engine for inclusive growth.