The National Insurance Commission (NAICOM) has issued a firm warning to insurance companies across Nigeria, urging immediate compliance with mandated claims settlement practices to avoid severe penalties. The regulatory body emphasized that persistent delays or denials of legitimate claims undermine policyholder trust and violate industry regulations.

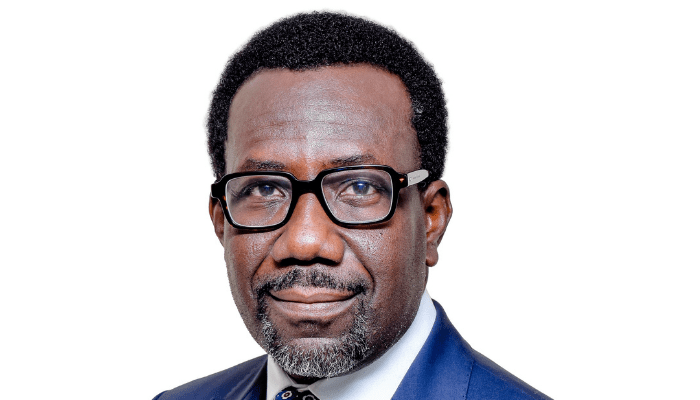

In a recent directive, NAICOM underscored the critical role of timely payouts in maintaining the sector’s credibility. “Prompt claims settlement is not optional—it is a legal and ethical obligation,” stated Commissioner for Insurance, Sunday Thomas. “Insurers must prioritize policyholders’ rights to foster confidence in the industry.”

The commission revealed plans to intensify monitoring efforts, requiring firms to submit detailed quarterly reports on claims resolution metrics. Companies found non-compliant risk facing escalating consequences, including substantial fines, temporary operational suspensions, or outright license revocation.

NAICOM’s crackdown aligns with broader goals to enhance Nigeria’s insurance penetration and economic resilience. The sector, pivotal in mitigating risks for businesses and individuals, has faced criticism over consumer dissatisfaction and low uptake of policies. Thomas stressed that accountability measures aim to “strengthen transparency” and align practices with global standards.

Industry analysts applaud the move, noting that efficient claims processing could spur growth and attract investment. Policyholders, meanwhile, express cautious optimism, hoping for tangible improvements in service delivery.

As regulatory scrutiny tightens, NAICOM reaffirmed its commitment to safeguarding consumer interests while fostering a robust, competitive insurance landscape. The commission urged Nigerians to report grievances, assuring swift investigations into alleged malpractice.

This development signals a pivotal shift toward accountability in Nigeria’s insurance sector, with implications for both corporate compliance and public trust.