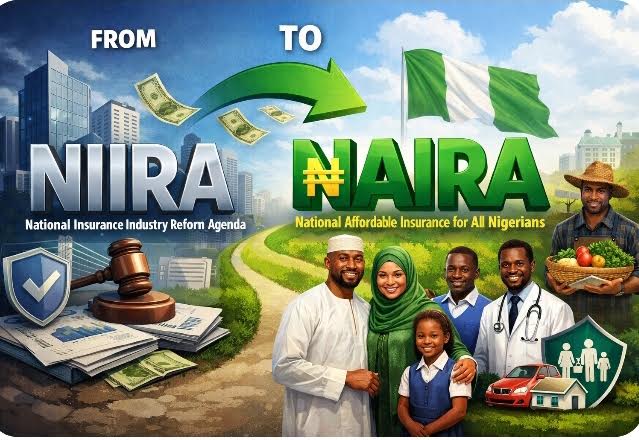

With the full implementation of the Nigeria Insurance Industry Reform Act (NIIRA) 2025 commencing this year, operators in the insurance sector face a defining moment—one that could determine whether the industry finally breaks free from decades of slow growth and weak public confidence.

For years, insurers have struggled to assert their relevance within Nigeria’s financial system, often viewed as the “poor cousin” of the banking sector. Despite repeated calls for reform, the industry remained constrained by outdated legislation and weak capital requirements under the Insurance Act of 2003.

That narrative has now shifted. With the passage of NIIRA 2025 and the accompanying risk-based capital framework, the regulatory gates have been thrown open. The challenge, analysts say, is no longer the law itself but the willingness of operators and regulators to implement it fully.

Insurance lags behind banking and pensions

As of December 2025, insurance contributions to Nigeria’s gross domestic product (GDP) remained below 1 per cent, underscoring the sector’s limited economic footprint.

By contrast, data from the National Bureau of Statistics (NBS) show that the broader finance and insurance sector—dominated by banking activities—contributed 4.57 per cent to GDP in nominal terms in the second quarter of 2025. The banking sector also attracted about 55.44 per cent of total capital inflows in Q1 2025, amounting to $3.1 billion of the $5.6 billion recorded during the period.

NBS attributed the banking sector’s strong performance to increased financial activity, investor confidence, and sustained oversight by the Central Bank of Nigeria (CBN), even as policy conditions eased to support domestic growth.

The pension industry presents an even starker contrast. Pension assets stood at ₦26.09 trillion as of September 2025 and rose to ₦27.05 trillion by November, accounting for about 7.1 per cent of Nigeria’s 2024 GDP. Total pension assets under management reached ₦26.66 trillion in October 2025, representing a year-on-year growth of 21.63 per cent.

Although NBS reports typically aggregate banking, insurance, and pension activities under the finance services sector, insurance remains the weakest contributor—reinforcing its long-standing marginal status.

A new law, a new test

NIIRA 2025 is widely seen as an opportunity for the insurance industry to rewrite its story. Analysts argue that the law provides a clear framework for growth, transparency, and accountability—if applied without compromise.

Central to the new legislation is a renewed focus on claims settlement, an area that has long undermined public trust in insurance.

Experts insist that insurers must demonstrate a fundamental attitudinal shift toward prompt and transparent claims payment, as NIIRA 2025 explicitly targets non-settlement of claims.

The Chairman of the Nigeria Insurers Association (NIA), Kunle Ahmed, has said the industry plans to deploy technology to eliminate claims fraud and disputes by digitising claims collation and tracking. This, he noted, would enhance customer experience while reducing fraud.

The Commissioner for Insurance, Olusegun Ayo Omosehin, has also taken a hard stance, declaring zero tolerance for unpaid claims. From 2025, insurers are expected to stop carrying unpaid claims as figures in their financial statements.

Brokers, premiums, and penalties

Beyond claims settlement, NIIRA 2025 tightens rules around premium remittance and broker conduct.

Section 61 of the Act mandates insurance brokers to remit collected premiums to insurers within 20 working days or 30 calendar days—whichever is later—either from the date of receipt or the effective date of cover.

The law reinforces the “No Premium, No Cover” rule under Section 60, making insurance coverage invalid until premiums are paid and remitted. Insurers who provide cover without receiving premiums face stiff penalties.

Brokers are also required to maintain dedicated client accounts for premiums and claims payments, preventing the commingling of client funds with operational accounts. Failure to remit premiums attracts penalties, including payment of the outstanding premium with interest at 2 per cent above the CBN’s Minimum Rediscount Rate, as well as fines of ₦500,000 or twice the commission earned, whichever is higher.

Additionally, brokers must submit audited financial statements to NAICOM annually by June 30, with auditors required to confirm full remittance of collected premiums.

Implementation will determine success

Analysts warn that selective enforcement could undermine the law’s effectiveness. Insurers who overlook brokers’ failure to remit premiums—often to preserve business relationships—risk rendering NIIRA 2025 ineffective and dragging the industry back to old practices.

At the launch of the Nigeria Insurers Association’s technology lab, one insurance executive told THISDAY that while operators welcomed the new Act, its success would depend on insurers’ willingness to allow the law take its full course—even when enforcement proves uncomfortable.

That sentiment underscores the task before the National Insurance Commission (NAICOM): to enforce NIIRA 2025 without fear or favour. Industry watchers argue that only strict, consistent implementation—regardless of the consequences for insurers, brokers, or government agencies—can restore credibility to the insurance sector.

As NIIRA 2025 enters its first full year of operation, the question is no longer whether Nigeria has the right insurance law, but whether the industry has the discipline to obey it.