Universal Insurance Plc has announced plans to prioritise digital transformation, product expansion and strategic partnerships in 2026 as part of efforts to strengthen its revenue base and market position.

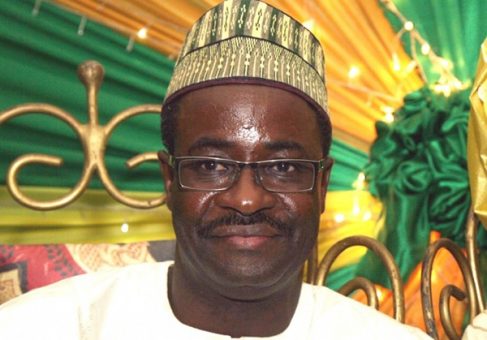

The company’s Managing Director, Dr Japhet Duru, disclosed this at Universal Insurance’s 2026 Annual Thanksgiving and Prayer gathering held at its Lagos head office.

In a statement issued on Wednesday, Duru said the insurer would focus on enhancing its digital capabilities to improve customer experience, broadening its product portfolio to meet changing customer needs, and deepening partnerships to drive growth and innovation.

He reaffirmed the company’s commitment to protecting policyholders’ interests while strengthening its operational capacity in the coming year.

Duru also urged employees to uphold the firm’s core values, stressing that professionalism, integrity and the prompt settlement of genuine claims would remain central to its operations.

“We are excited about the opportunities ahead and remain committed to being a trusted partner in protecting what matters most to our clients,” he said. “Customer satisfaction through professionalism and timely claims settlement remains our top priority.”

Reviewing the company’s performance in 2025, Duru said Universal Insurance recorded notable achievements, including expanding its product offerings, improving digital services and strengthening its presence in key markets.

“These milestones reflect our commitment to delivering value to our clients and stakeholders,” he said, adding that the company was pursuing a bold agenda focused on innovation, customer-centric solutions and sustainable growth.

On recapitalisation, the managing director confirmed that efforts were ongoing to ensure a successful process, noting that the company would continue to expand its footprint within Nigeria’s insurance sector.